How to earn points and miles

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

This post is part of our new series that will make up the Million Mile Secrets Learning Center.

So, you know what points and miles are and have heard all about the awesome benefits associated with them. Hopefully, you’re considering becoming the proud owner of a shiny, new travel rewards credit card.

The million-dollar question now becomes, how do you earn lots of points and miles so your next trip can be free? Earning them is easier than you think, and you likely don’t have to change much in your life to be able to do it.

Flying and staying in hotels

The most common and well-known way to earn points and miles is by actually traveling. Airline points and miles are accumulated when you fly, and when you have enough you can use them to book your next flight. Almost every airline has a different airline loyalty program that determines how many points or miles you earn for flying. American Airlines has AAdvantage and United has its MileagePlus program.

Similarly, staying in hotels will allow you to earn hotel points. All major hotel chains have hotel loyalty programs, where you can earn points and receive benefits from staying in their locations. Popular programs include Hilton Honors, Marriott Bonvoy and World of Hyatt. Like airlines, no two hotel programs are the same and all have different systems — so you’ll be earning points at different rates.

While traveling is the most traditional way to earn, most major airline and hotel loyalty programs have shifted to revenue-based award systems — this has made it harder for the common traveler to earn lots of points and miles. Whereas before you’d earn miles based on the actual number of miles you flew, now you earn based on how many dollars you’ve spent with the airline. All hotel award programs are revenue-based as well. For example, as a basic Delta SkyMiles member, you’ll earn 5 SkyMiles per dollar spent on Delta flights.

So really, unless you’re a business traveler and work is paying for most of your travel, earning points and miles through actual travel is probably the most expensive way to accumulate award currency.

Credit Cards

Credit cards are the easiest ways to start earning points and miles — whether that’s through an airline’s co-branded credit card or a bank’s flexible points program. There are two primary ways you can earn through credit cards, everyday spending and welcome bonuses.

Spending on a credit card for everyday purchases

One of the easiest ways to earn points and miles is by simply using your rewards credit card to make your everyday purchases. Swap out your debit card and cash for strictly rewards credit cards, and you’ll start seeing the perks come flooding in. As long as you can control your budget and not overspend, you’re essentially losing money by not using a rewards-earning credit card.

For many cards, you get the highest return of points and miles for spending money on travel-related purchases. But, you can also get points and miles for other activities, like dining out or ordering takeout and using taxis or ride-hailing services. You can even earn bonus points and miles by making your typical weekly purchases like gas and groceries!

Every travel rewards card has its own system for points earning by spend category, so be sure to look extensively into the specifics of your card’s reward structure. This way, when you splurge on a big purchase, you’ll know the right card to use to maximize the points in the relevant bonus category. Finding a card or two with bonus categories that matches your spending habits can help you rack up the points quickly.

If a lot of your money goes towards travel purchases and eating out the Chase Sapphire Preferred® Card would earn you 2 points per dollar spent on travel and 3 points per dollar spent on dining, while you’d earn 1 point per dollar on all other non-bonus purchases. If you spend a lot of on groceries, the American Express® Gold Card could be a good match, since it earns 4x points at U.S. supermarkets (on up to $25,000 per calendar year; then 1X).

Credit card welcome bonuses

When you first get a rewards credit card, make sure you pay special attention to the bonus the card offers. Almost every card has a welcome bonus, which means the issuer will award you points or miles for signing up and actually using their card. To receive a welcome bonus, you typically have to spend a certain amount of money in a specific amount of time after opening the card; for example, $3,000 in the first 3 months of opening an account. Once you do this, you’ll typically be awarded a large number of points or miles, which can equate to a high dollar value.

For example, the Chase Sapphire Preferred® Card earns 60,000 bonus points after you spend $4,000 on purchases in the first three months of account opening. Those points are worth up to $1,200 according to our points and miles valuations.

But don’t be fooled, because sometimes the largest welcome bonuses don’t actually have the highest values. Make sure you’re getting your bang for your welcome bonus buck, when you sign up for a card! Make sure to read our points and miles valuations post to figure out how much a welcome bonus is actually worth.

Another awesome bonus some cards offer is an anniversary bonus. With these, a card rewards you with points or miles once a year for being a loyal customer. This is another easy way to earn points and miles, as long as you’re using your card and paying it off monthly.

Refer a friend bonus

Many banks offer a refer-a-friend program where you can refer a friend or family member to a credit card you have and receive a bonus when they sign up through your link. Bonuses range anywhere from 5,000 airline miles to 25,000 bank points, your bonus depends on a variety of factors like what card you hold and the time of year. You can read our in-depth guide to credit card referral programs to know which cards and banks offer bonuses.

Online Shopping Portals

You can also earn points and miles nearly every time you shop online, by using online shopping portals. Most airlines and banks (and a few hotels too!) have online shopping portals that connect you to major retailers.

To use them, instead of going directly to the retailer site that you’re looking to purchase from, add in an extra step and go to the airline or hotel online shopping portal. Then, use the online shopping portal to redirect you to the retailer site, and begin shopping as usual. By adding in this extra step of using the shopping portal, you’ll automatically receive points or miles if you purchase nearly anything on the retailer site (plus you’ll get double rewards if you make the purchase with your rewards credit card — talk about a double-dip!). And no, there’s no catch — the retailers don’t raise the price if you click through a shopping portal.

A great way to find out how much you’ll earn from retailers through shopping portals is by using shopping portal aggregators like Cashback Monitor. On these sites, you can type in a retailer and see what rewards you can get by using a shopping portal.

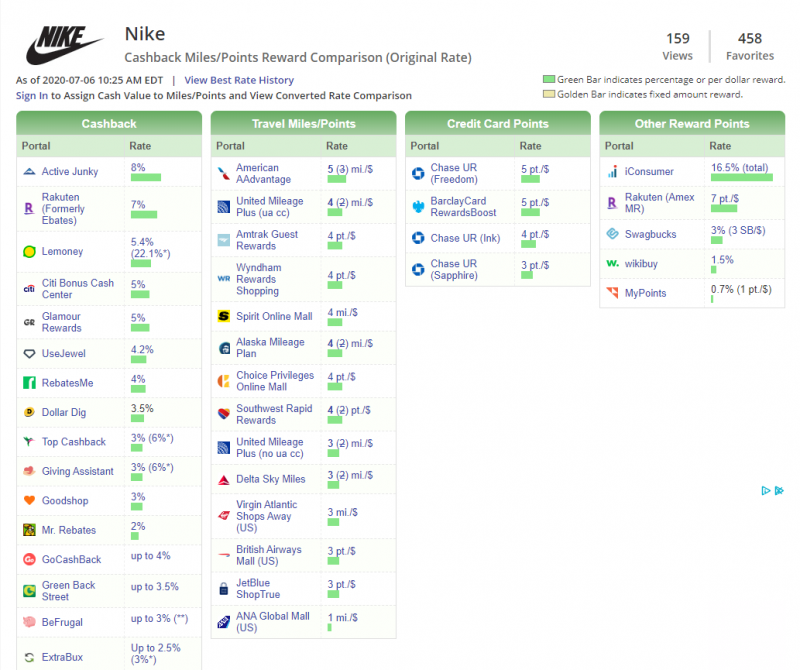

For example, say you’re shopping on Nike for new shoes that cost $150. According to Cashback Monitor, here are all of the rewards you can get by purchasing your shoes through a shopping portal instead of on Nike.com:

So, if you buy your $150 shoes through American Airlines shopping portal you’ll get 5 miles for every dollar spent.

$150 x 5 miles = 750 miles earned! That’s 750 miles you otherwise wouldn’t have had, for making a purchase you were going to make anyway.

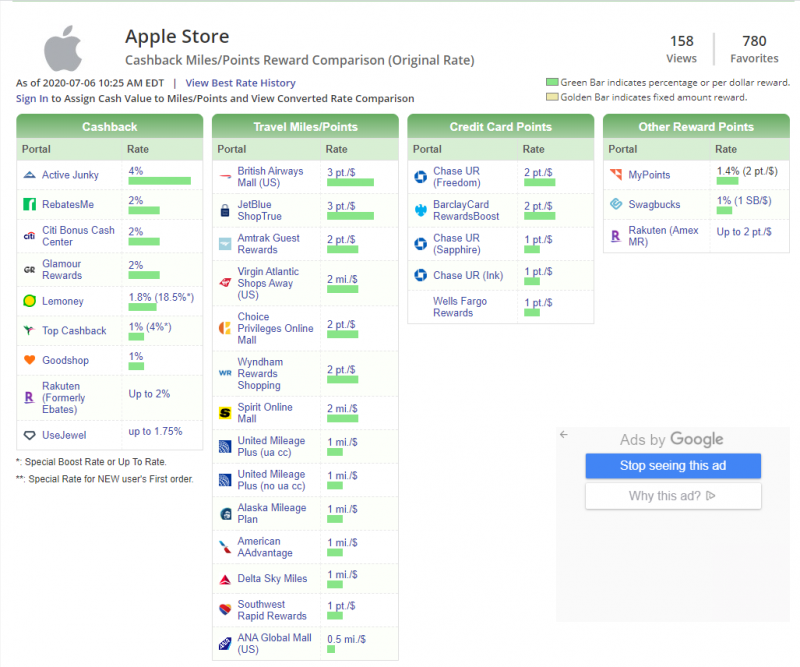

Similarly, if you’re looking to buy a new phone case from Apple that retails for $40, you can earn these rewards by using a shopping portal:

By purchasing your phone case through the Chase Freedom Shopping Portal you’ll earn 2 points for every dollar spent.

$40 x 2 points = 80 points earned!

Using shopping portals is an easy way to earn miles — all you have to do is add a couple extra clicks to your online shopping routine. By not using these portals for online purchases, you’re only missing out on extra points and miles and losing money.

Dining Programs

Similar to shopping portals, dining programs give you the ability to earn points and miles for doing something you would anyway — eating at a restaurant. With dining programs, select restaurants partner with airlines and hotels, to get you rewards for dining out. These rewards are in addition to the rewards you earn if you pay for dinner with your rewards credit card, so it’s another double-dip.

A program called the Rewards Network makes earning rewards from dining out a breeze. When you visit the website, first you choose the type of reward you’d like to earn (points, miles, cash back etc.). Then, you securely link your credit/debit card to the site. After that, the site will show you local restaurants in your area that participate in the program and all you have to do is go out, eat, and pay with your linked card.

The Rewards Network partners with all of these travel companies, so all you need to do is pick a program you’re interested in earning rewards from, type in your zip code, and see all the surrounding restaurants in your area where you can earn:

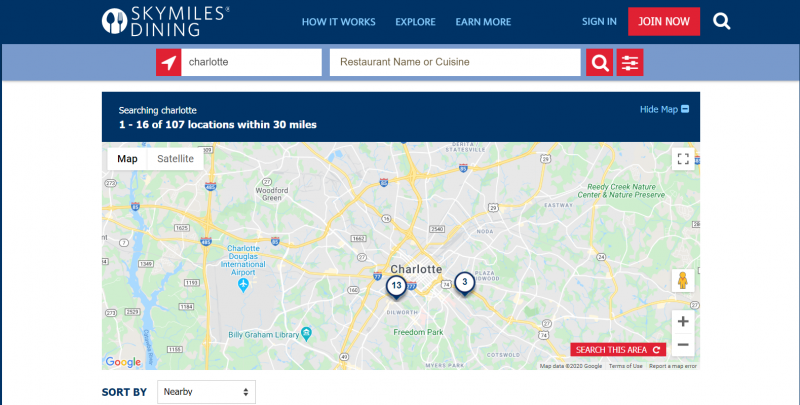

For example, if you’re looking to earn Delta Sky Miles by dining in Charlotte, NC, you’ll find you have 107 local restaurants that will help achieve your travel goals!

Bottom line

Earning points and miles isn’t something you need to spend a lot of time or energy doing. Earning rewards can (and should!) be incorporated into your everyday routine, and you can do it without changing much of anything. By using shopping and dining portals, staying in hotels, flying and making everyday purchases on your rewards credit card you are literally earning free money. So what are you waiting for? Start earning your points and miles today!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!